[responsivevoice_button]

Venture Capitalists are those who gather as individuals to invest in ideas. Venture capitalists for technology startups are investors who provide financial and other backing to start a new company, usually because it is designed to supplement theirs or because the requestor is not an official employee and wants to work independently but needs money to get started to build its technology, or another reason is because the venture capitalist is seeking to utilize and shelter funds for tax purposes and chooses to invest in a proposal because it ensures a profit for them in the future. The profits are usually made in the future, where a percentage of the company, along with a payback plan is agreed on.

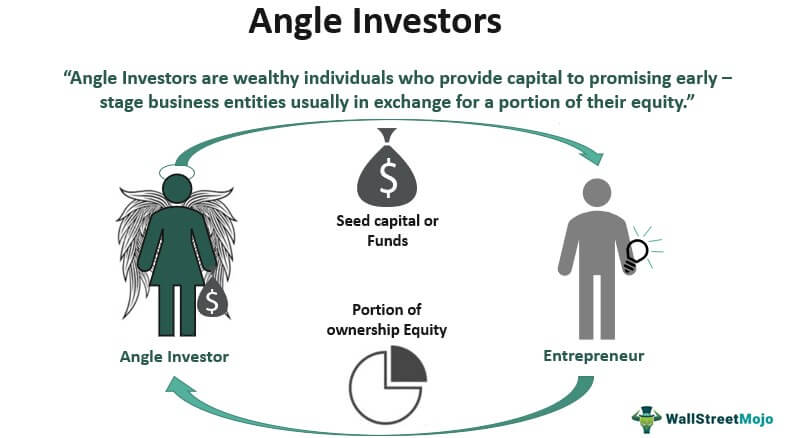

Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.

Private equity is not money provided by a company, corporation, or firm that is publicly owned with shares and traded on the stock market. The difference in type of company is that the private equity is money that is paid into a company that is profiting; it is a number on a balance sheet as part of a company’s value or assets, not considered ‘income’ or ‘disposable funds’ but equity. In homeownership, equity is available if and when the loan holder applies for an equity loan on the existing loan, up to the amount paid on the loan. It is not much different for operating businesses who have loans and paid portions of their loan. The wording is not clear as to how much or what kinds of loans are considered for private corporations, but it might be similarly restricted to only real estate or items called ‘real property’ which is categorized as business assets. Because of complicated accounting, an asset is considered company investments or purchases where there is a loan or was paid in full, with a depreciation formula to assess its value in comparison to condition and use over time. These are complicated formulas companies use to manage the value of their assets.

How do you know who/where to take your ideas to?

Is their an existing company that can benefit from your idea and what does your idea or proposal come with? Is it a new invention? A product, a service, a piece of software, a system? Is it something you can develop a prototype and sell to an existing company with the resources to take it world-wide? Investors are only needed when you plan to create a company and grow it using their investment money, with plans to provide ownership shares and payoff the loan at certain points. A company with a great invention must prepare a proposal to plan an acquisition deal for sale of the idea, or investment and part sale to implement the idea, depending upon what is needed. Some technology companies need other technology companies and expertise to make their ideas a success, thus requiring group investments, while others have grand ideas and no ability to put it into action because they have no money, time, resources, or means of making it a profitable invention. The best route for these ideas are patents, trademarks, and sales with specific production plans and restrictions.

This project cannot be taken to a Venture Capitalist because it does not have a profitability or ownership plan; and because it does not have a development and implementation plan.

In 1901, J.P. Morgan bought Carnegie Steel Corp. for $480 million and merged it with Federal Steel Company and National Tube to create U.S. Steel in one of the earliest corporate buyouts and one of the largest relative to the size of the market and the economy. In 1919, Henry Ford used mostly borrowed money to buy out his partners, who had sued when he slashed dividends to build a new auto plant. In 1989, KKR engineered what is still the largest leveraged buyout in history after adjusting for inflation, buying RJR Nabisco for $25 billion.

Raising capital for a startup company requires what is called ‘due diligence’ or investment consideration with future plans for the startup company, whether its long term investment in the startup or the startups plans for the company – to grow, sell, or be a temporary technology creator without corporate bindings and limited legal liability, or to simply invest in the startup phase to assist the formation of a company. Some investments go so far beyond the startup phase to corporate buyouts and mergers, and some develop into competitors, while others remain paybacks and part owners, depending upon investment negotiation, agreements, and changes.

Are the stars of Shark Tank actual billionaires investing their own money or are they decision makers for corporations and fund investors for private equity funds, where the source of the money is unknown, not their own, and is a constant source of investment money set aside for hollywood? Are they real business ideas and money and if so, why don’t they have a follow up show and offer an opportunity to invest in the businesses they are part owners in, that will ensure the growth of those companies or encourage public service offerings as part of a group fund, available for investment?

It is believed the source of funds are unknown to the stars of Shark Tank, even though they call it their own money. If it is their own money, then at some point, their money will run out and they are not willing or able to show how their investments have grown.

Shark Tank shows the process of presenting ideas to Venture Capitalists. It’s realism might be truthful, but lacks follow up and success metrics. They don’t know or don’t tell us if their investments were a success.