[responsivevoice_button]

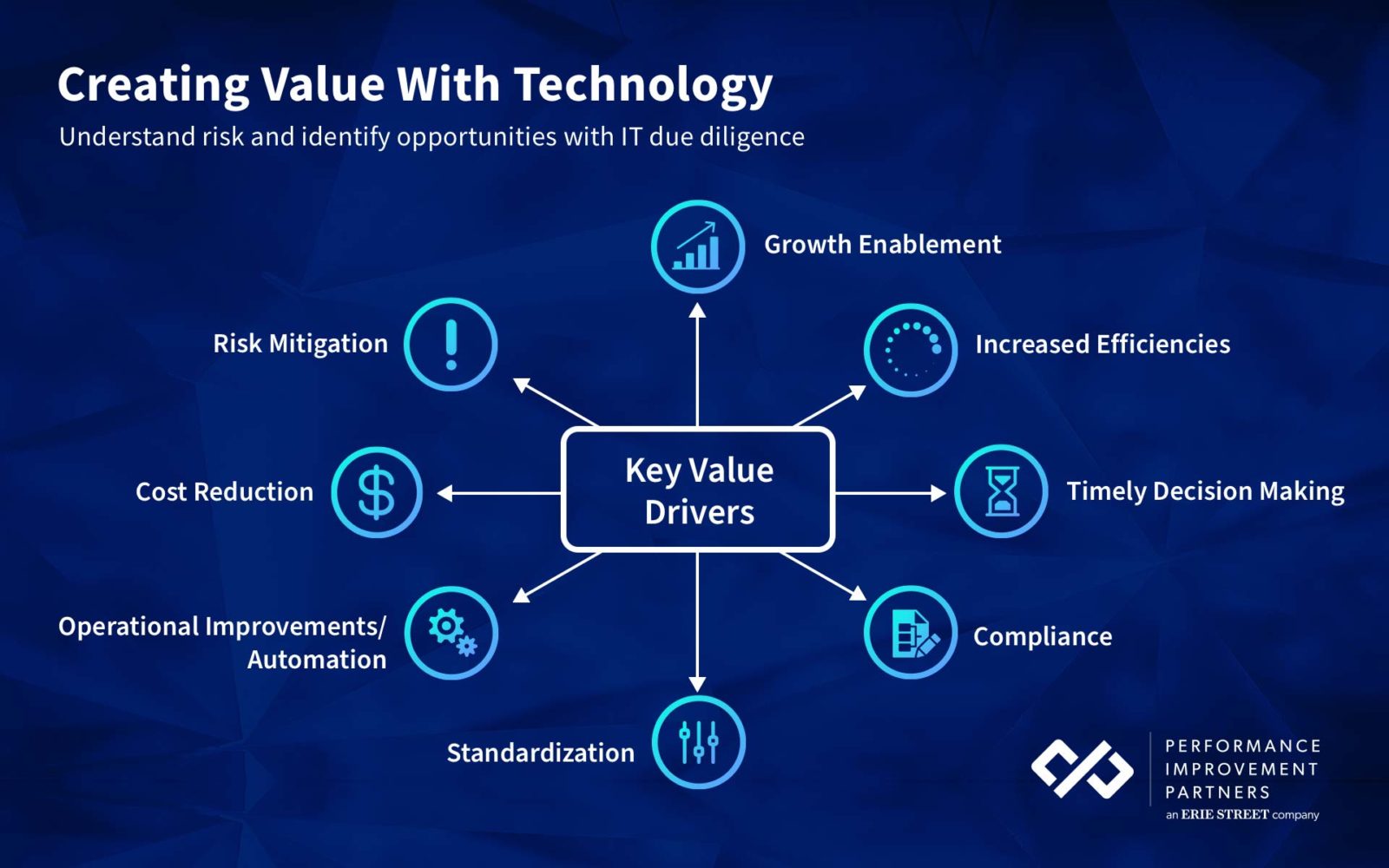

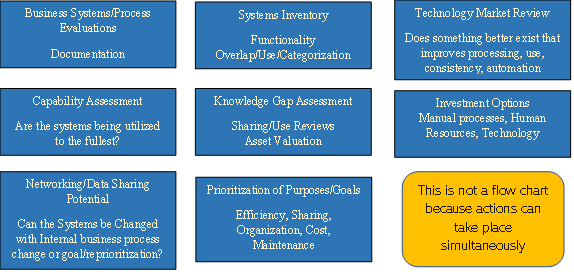

Acquisition, merger, and alliance considerations are made when a firm or company has spent time exploring opportunity to grow and be more innovative. These decisions are usually made because of the need to update systems, gain in market share, or improve business operations. Companies and firms that operate innovatively and are top in the marketplace are those that accept and are open to change, improvement, and want to offer the best to the customers and provide the best working environments for their employees. This sometimes requires the acquisition of companies, technology, as well as mergers or the formation of alliances to achieve its desired goal or intended purpose. For this to be effective, and a beneficial reality for them, they need to know their standings in the marketplace, in comparison to its competitors or other companies, employee challenges and preferences, as well as what is possible. This is a phase called pre-acquisition due diligence. Because Acquisitions, Mergers, and Alliances are different forms of agreements and processes, they must have a qualified advisor to lead them with the best direction for its desired goal and sometimes this requires a serious in-depth strategic planning and goal setting review. While it may seem companies, executives, and management are solely focused on the bottom line, the profit, each level serves a specific purpose, and they must all work together for the benefit of the company and the people and things that make the company successful, which extends well into suppliers, manufacturers, customers, family members, and even neighbors of the company. Considering impact before setting specific goals is not the correct order or prioritization of acquisition considerations. Before the acquisition of technology or a technology company, the buyer should evaluate its existing portfolio and capabilities to know exactly what it has, as well as what it thinks it needs. Strategic goals are often created prior to the consideration of purchasing technology and to achieve certain strategic goals, such as efficiency, companies often find that technology will assist in meeting those goals. It’s a simple understanding that technology reduces human effort, makes things much more efficient, easier, and more enjoyable, works interchangeably with humans, and can provide a level of business insight that takes maybe four times the amount of time that a computer system or the general category called ‘technology’ can. This effort is started by completing a technology inventory and systems review in comparison to what the market offers.

Before even purchasing or shopping, the company should have a good understanding of its performance to clearly see what improvements or gains have been made post acquisition. After acquisition consideration, fine tuning existing systems might be the best option, at least until the company learns to take full advantage of its existing resources before it seeks to buy something new. It’s like buying a high-tech vacuum cleaner because it’s the latest invention, when the existing vacuum cleaner works perfectly and is just a little bit louder. Acquiring an entire technology company is done for more reasons than just gaining capability and improved ease of use. It’s done to either modernize its existing technology or to add technology to improve its product or output. In the case of the vacuum cleaner, it’s not just the functionality of cleaning the floor, but the operators experience and preference. Advanced manufacturing companies with modern technology or some other type of business where technology has been implemented at a small company and proved it operates effectively and is worth the investment are perfect alliance opportunities and potential acquisitions or mergers. Companies compare performance to convince themselves and prove the difference; this is part of the due diligence phase of acquisition or merger consideration. It’s not just the financials that are important, but also performance metrics and measurements, including how drastic or long the implementation might take, as well as how the company might be disrupted or changed. Companies should not wait for problems or use them as a prompter of acquisition consideration. Strategic company goals are high level goals, where more detailed goals must be created for the specific acquisition, and they should directly align with the higher-level goals. It’s far too simplistic to say that the acquisition or merger must create value for its company, its stakeholders, or its customers. The value that is created can only be understood after a cost benefit analysis, as well as technology evaluation. In technology, cost benefit analyses are not simple side by side comparisons and neither are company competitive analyses. Controlling pre-acquisition decision work is necessary to not over-invest in something that proves to be of no value or to move forward with an acquisition because of the investment in the due diligence phase, even though it is clear the deal will cause more harm than good or that the results are unclear and unknown. In the simplest words, it is not wise to move forward with a purchase just because a company spent time and money in researching the possibility of a purchase and should move forward because the time and money would be considered wasted if not completed. This is not true because the investment has resulted in lessons learned that can be applied to its best practices and other areas to perfect its buying process.

It’s important that decision makers don’t ‘make deals’ just because they invested in research in its systems and potential new technology. Investing in technology reviews and inventories of existing systems should be an ongoing operation or regular function within a company, done internally, as well as externally or by another trusted company so they already know its value, critical systems, leadership, or standings in the marketplace and be able to quickly compare it to something more modern or upgraded to make the decisions. Gaining market share for profitability purposes is a function of the sales department, in connection with operations, and technology; all working together to position the company in marketplace. Technology positioning in the marketplace or being top and number one in the marketplace must be looked at in another way and separate, to consider market standings and share being a review of the best technology in comparison to their profits, losses, and operational process metrics to truly compare and score themselves with other technology, as well as those using the same or different technology. Competitive business analysis as an ongoing operation gives companies insight into their standings in relation to their competitors, but company comparisons should not be its number one purpose or ‘competitive’ metric or goal. Internal operations, employee and customer satisfaction, social and economic impact, as well as environmental metrics must be established because any changes in technology affects each of these areas.

Evaluation and Control System – Acquisition consideration

- Avoid single system button by button or feature by feature comparison

- Focus on overall business outputs, what is, what should be, what could be

- Review Data Insights/Reorganize, Create New Views of Information/Output

- Identify reasons for purchase beyond ‘functionality’ or ‘features and benefits’

- Ensure shopping is not being done out of boredom, routine, or to obtain a small gain

- Create a process for manual vs. computerized comparison and create a strategic plan or seek to align with larger goals and strategic plans; review and reorganize for regular reviews

- Do not rely on a single diagram or small visual to know everything it requires or involves

Goals

- Improve information processing, automation, and sharing, integrating systems for data management (Company or Acquisition System Specific Goal?)

- Review and update policies and manage procedural changes using technology

- Stay focused on learning more about what systems can and should do and how they are used differently departmentally and across business units and industry

- Use creative innovation and strategic planning and if not available for acquisition, merger, or alliance, consider development

- Maintain appropriate training at intervals and instill personal and professional responsibility in knowledge management

- Create and manage internal and external goals with ethics and responsibility

- Decide on what level of staff should handle what, encourage innovation, and share some authority

A company’s operating agreement and business structure determines its buying power and controls the acquisition and merger activities. Larger companies, with a board of directors, shareholders, and executive staff do not make these decisions unilaterally. Decisions to invest in purchase technology above a specific threshold, usually managed in cost terms are made at certain levels, such as managers are authorized to make purchases no higher than $50,000 annually. Such a buying structure is certain to lead a company to dysfunction if technology decisions are not made collectively simply because the way technology now works, which is on a networked system that serves more than just one department or one user. Buying decisions are not solely given to managers or executives, in fact, because of technology’s impact, it must involve its shareholders, but not in every case. Setting acquisition rules requires executive leadership and evaluation of corporate impact, as well as industrial impact, beyond what benefits and risks the company will enter with the purchase of a small $20 piece of software, the removal and replacement of software, or the termination of staff members who perform a critical task of security protections. Basing acquisition decisions or giving decision making authority and buying power to its leadership based on financial thresholds or dollar amounts is not an effective technology budgeting and buying strategy. Because technology and its impacts vary, business planning and analysis and budgeting strategies also vary. One ‘due diligence’ and acquisition consideration work process will not fit every type of technology, although the high-level process is similar each time. Just as the decision to fill a vehicle with the tank of gas at the nearest gas station is a simple price, quality, loyalty, and availability decision, sometimes automatic and required, the purchase of a brand-new vehicle is not the same, although the buying considerations are price, quality, loyalty, and availability, and not solely selected or different because the cost and financing structure differences.

It requires several levels of management review before any buying decision is made. This work requirement of impactful research is necessary because even the smallest purchase has been reported to damage entire companies. The “ILOVEYOU” virus and its numerous variants have cost businesses, governments, and other technology users a total of $6.7 billion in damages so far, according to an estimate released by Computer Economics Inc. in Carlsbad, Calif (Computerworld.com, 2000). The same is true for larger purchases or those that require specific skill and oversight to implement, where the rewards are not realized or reaped until post implementation, making its staff or the managers of the implementation directly responsible for its success. These are risk areas managed by more than trust, but also qualified teams who can make buying and implementation decisions with more than just reliability and loyalty established. There is another risk area where matters of the law govern, which are violations of contractual agreements or agreements made in bad faith. These are areas the companies never want to have to utilize, but do because of market competition or other hidden agendas, and now necessary requirements thus making the acquisition process lengthier with more information gathering, documentation, and strategic management before enabling the execution of agreements, otherwise known as fulfilling contractual obligations as agreed upon and required by law and policy.

Evaluating and controlling acquisition projects becomes difficult when resource requirements vary with different potential outcomes, or that purchases must be prioritized and specific measurements for each project or ‘technology’ that is considered. The ‘measurements’ or value the acquisition brings is not a standard formula or mathematical equation that determines its worth or potential in meeting its goals, although the evaluation of such ‘value creation’ in alignment with set specific goals is a similar process. A ‘churn em and burn em’ production approach to business is not guaranteed to lead to market crash and the great depression, but the lessons learned in the 1950s and other recessions show the necessity for consistent production rates and profits with spikes offering clear answers to cause and effect. This is where technology plays one of its greatest roles and is most critical. Improving production and profits is one goal, but if the company relies on churn em and burn em, with high employee turnover rates leading to healthcare problems, dysfunctional and non-skilled technology staff, and a constant need to shop or trade and risk manage, then the company is most likely headed for a catastrophe if its systems do not give the necessary insights that assist in acquisitions or even ‘competitive analysis.’ Company knowledge, insight, and factual representation of its operations, worth, capability in relation to others in the marketplace are necessary needs, reliant on technology to provide this insight. Growth is another important area of acquisition consideration and insight that has changed with technology. It was once believed that growing in number of employees increased company capability and profits, resulting in higher productivity and because of technology, this is no longer a fact. Alternatively, technology is often seen to be a contributor to economic downturn because it often replaces human effort, causing an unemployment rate to increase. These problems are avoided with responsible planning that extends beyond the company goals, but also economic and environmental impact. An excellent acquisition or merger strategy, when using technology to replace or change human productivity is to consider using one company or part of the company for modern technology and compare it to the human operation part to truly see what it can do, does, and to make preferential decisions centered around more than just ‘information’ and capital or cash flow. How these decisions are made, based upon what information, who, at what level, and how and in what order they are presented to the company, its board members, and shareholders affect the success of the buying or selling actions. Company responsibility and justification of layoffs or unemployment is not required by law, but reporting is and is considered an ethical decision and although companies are not responsible to report economic contributions or plans of increases or downturn, and the reasons for such change, they are happy to self-report achievements and not economic disasters. Economic or industrial responsibility or contribution metrics should be understood for a company to truly know and understand its necessity and impact in the world, as well as what makes it so. Acquisitions rarely come down to a decision to pay humans or buy technology, although the decision to acquire technology later results in the replacement or reduction of employees simply because of technology advancements. This causes concern in the workplace because of its economic impact, but with proper repositioning and concurrent investment in skill building, the company can improve in both areas, and both can thrive. Human resources or resource management comes down to matters of responsibility and who takes it and creates the most effective and successful outcome. When employees grow in skill, along with acquisition implementation, it improves operations, but not with fear of no longer being needed or because they are replaced by technology. This is in fact a possibility that humans express what the previous technology feels or thinks – fear or excitement of replacement, which is managed by planning its retirement, sale, move, or improvement, of which they will always be a part of the company, human, and possibly technology’s history. Employees are not often viewed as ‘being for sale’ however, in an acquisition, employees are an optional part of the sale.

Implementing technology after acquisition requires a project plan. During implementation many unknowns are identified, which impact the project timeline, resources, and financials. It is best to have the critical things worked out prior to purchase, but it is a fact that unforeseen problems are presented that affect the plan in the ‘blending’ of the systems post acquisition. Simple acquisitions are basic technology projects, where software or hardware is installed, upgraded, or changed that offers new functionality and features, which in turn changes processes and requires training. The best post acquisition advice is to ensure that the project stays on track and the employees stay focused and motivated to welcome changes for it to be a success and that the right facts and opinions are known and utilized. It’s not just the technical aspects that are important, but how the company and its people adapt to the new changes. New technology is like a new employee or department; therefore, it must be carefully selected, integrated into the company, and its users must know how it works and be able to manage it and enjoy it. Management must also understand and plan for training and slower periods of lower performance, or on the flip side, prepare and plan for improved performance once it becomes a regular part of their operation.

An Evaluation and Control System for Acquisitions

A company should already have a clear evaluation process in place for its existing technology. If it does not have one, then it should evaluate its existing systems before acquiring another one. The evaluation process should have clear documentation and well understood and communicated value, beyond numerical, but how important it is to its company’s operation and how it contributes to the many areas, both internally and externally. It’s impact to employees, if changed or removed should also be considered, as well as how well its users know and like the system. The functions that the systems serve should also be evaluated and when conducting a technology evaluation, systems should be looked at on a group level, as well as individually, to find ways to integrate and discover, buy, or build a better system that serves more than just one or two purposes or groups. Enterprise systems are becoming more valuable because they are not individually managed but are server-based applications that service the whole company, rather than 25 small applications where there are separate vendors, maintenance agreements, processes, and system capability overlap. Evaluation of the existing system(s) in comparison to what is available in the marketplace for acquisition is important and cannot be a one-to-one comparison of old and new because many changes with newer technology. Evaluation and control processes are combined because they are intertwined (White & Bruton, 2017). Such changes involve staffing, training, and process changes where investment is required to truly reap the rewards the new system offers. This requires an understanding that it is in fact an investment, which needs to be shown in clear terms prior to acquisition. It can’t be stressed enough that the ‘value’ and ‘investment’ areas are not solely financial figures, but also operational performance and business process management. With new technology comes training, which slows operations, which in turn, slows profitability; all of which can be managed effectively with the right planning. With new technology also comes efficiencies which most likely includes layoffs, requiring strategic planning using confidentiality of what the system can and will do. Controls are necessary in each area, especially when considering what technology to acquire, how to start the process, where to buy, and what will change. It’s not just implementation and ‘project’ controls that must be managed, but also pre-acquisition efforts, including the level of effort put into reviews, evaluations, and valuations of existing systems with intent to replace. Sometimes it is easier to decide that the company needs to acquire new technology without an in-depth review and comparison to what is already in place, because they already know that there are far better systems available for purchase. Comparing systems is required to have a clear understanding of the technology’s value and how it changes processes, output, productivity, workplace climate, things, but the level of review and evaluation must be controllable, as must the process of acquisition or the ‘shopping’ and ‘selecting’ of technology.

It is believed that firms choose alliances rather than acquisitions because they either cannot afford to buy or because they are unable to endure the planning that is required to implement, even though it may bring long term greater rewards. From a psychological standpoint, there is evidence that companies choose alliances for the need to avoid being alone in its endeavors or because it knows that two are better than one and teamwork is required and beneficial for certain endeavors. Although a company might want to shop alone and use the new technology all alone, it is not always best or most advantageous for the nation to be the only one, therefore group buying opportunities have been made available, called partnerships or special operating plans with special legal structured agreements, of varying level of detail and complexity. If a nation’s goal is to be an effective world leader and is centered on capitalism, protection of human rights, environmental management, and oversight, as well as prosperity, then it’s the management of its investment decisions must be closely evaluated and aligned, as well as the rest of the nation. Individualized, non-strategic acquisitions, partnerships, alliances, and planning creates a disconnected system where technology has been designed to unify the world in its endeavors of not just ‘repeating history’ but revolutionizing ‘value’ while preserving traditions and creating new ones. Full compliance and alliance with nations in the world does not bring national peace and prosperity and should not be sought until its internal systems are evaluated and well-functioning, although this is often what prompts international study and possibly acquisition to be a better functioning world. With only a few nations functioning as North Atlantic Treaty Organization partners it might be the best organization to make the world’s technology plans, but not if military technology and commercial technology are in constant competition around the globe, with conflicting agendas and goals. Companies rarely make acquisition decisions based upon the political or international market climate unless it directly affects them in a visible and evident way.

Without strategic technology direction or ‘world plan’ for technology with corporate alignment and international management or implementation, most plans will remain small or not change the entire world. The creation of the “World Wide Web” or the “Internet” changed perspectives and enabled commerce and international communications, increasing opportunity, and widening the reach of everyone. The invention brought with it and entire host of problems that are sometimes unmanageable and created more harm than good. It cannot be accepted that the system was created with ill intent or plan to harm, but it can be easily accepted that the systems lack of management and strategic direction has caused unsurmountable problems that have resulted in both economic down and upturn, affecting national security and personal safety, those being at the top of the priorities list of more than just the United States Constitution. It’s more than just profits and productivity. Rather than to dump the system onto the next generation for use and management, its creators, businesses, and users must collectively make acquisition decisions for its improvement based upon what exists and what can be conceptually proven within the confines of reality and national structures. Not all citizens can be leaders and deciders of what makes up National Economics and Technology Advancements, just as not all employees can or should make buying decisions for its company. While a voting structure exists in corporate entities and is sometimes part of the acquisition process, it is only in place because of the cooperative working structure that a company is organized on and the psychology behind business as it relates to more than just human behavior, but also technology’s impact on it.

Sometimes it’s just not possible for firms to invest, therefore forming an alliance of some gives them opportunity to team up with others to get what they need, by creating trade offs or shared agreements until they can reach a point where one can acquire another. They also choose this to ‘test drive’ a company and learn a bit more about its assets without being forced to make an offer or a deal. Alliances help firms make decisions by enabling them to learn about what other companies are doing to decide if the technology and its associated processes are a good fit for them. Alliances are also formed for short term wins in the marketplace without having to buy technology or another company to gain. At the end of the day, they are separate companies whether they use a non-compete agreement or not and it benefits both companies when competing, as well as growing.

Leadership is a broad topic that is made up of principles of operation, often considered skilled, educated, or experienced direction or bravery where one person or group shows others how to proceed. Being in the lead does not mean the leader operates with logic or principles that are of commendable worth. Leadership traits can be listed, learned, and practiced, as well as utilized in many different situations, but knowing who is responsible and for what area is necessary, although many leaders lead without knowing and without reward. Many also lead with strict corporate and legal structuring which can sometimes create a ‘catch-22’ situation. A Catch 22 is : a problematic situation for which the only solution is denied by a circumstance inherent in the problem or by a rule the show-business catch-22—no work unless you have an agent, no agent unless you’ve worked Mary Murphy also : the circumstance or rule that denies a solution,an illogical, unreasonable, or senseless situation, a measure or policy whose effect is the opposite of what was intended, a situation presenting two equally undesirable alternatives a hidden difficulty or means of entrapment (Merriam-Webster, 2022). A few bad decisions that lead to national, corporate, or personal disaster cannot result in a constant punishment or reoccurrence, and it also cannot be constantly nurtured using the same structures, tactics, and processes as before. It is true that sometimes the bureaucratic or process of obtaining authority, managing authorities, or enabling empowerment in decision making is delayed or injury caused, and damages incurred, as well as missed opportunities because of poor leadership and workmanship or the decision-making process and ‘operating structure’ that someone else has created for us that we are forced to work. Therefore, people leave and choose not to operate in a corporate structure or follow the rules established by leaders. Corporate is related to the word ‘cooperate’ but forcing under unnatural or unwanted and dangerous conditions without confidence and a visible or promised reassurance of equitable outcomes and protection, there is dysfunction. A leadership “platform” will never be created, although people can write, automate, rewrite, speak, and act like they have the know- how and are effective, it’s not valued because there is no visible evidence of positive effect in direct returns of more than just monetary value. Buying companies, technology, or people only works until the monetary satisfaction runs out and the greater need beyond materialism, status, and image is required.

References

The Management of Technology Innovation: A Strategic Approach, 3rd Edition, White/Bruton,

2017

Computer World, ‘Love’ virus costs approaching $7B, research firm says, Ohlson, 2000, accessed

via the Internet at https://www.computerworld.com/article/2594882/-love–virus-costs-

approaching–7b–research-firm-says.html on November 15, 2022

Merriam-Webster, Catch-22 Definition & Meaning – Merriam-Webster, accessed via the Internet

at https://www.google.com/search?q=catch+22 on November 15, 2022